What lower inflation means for investors?

What lower inflation means for investors?

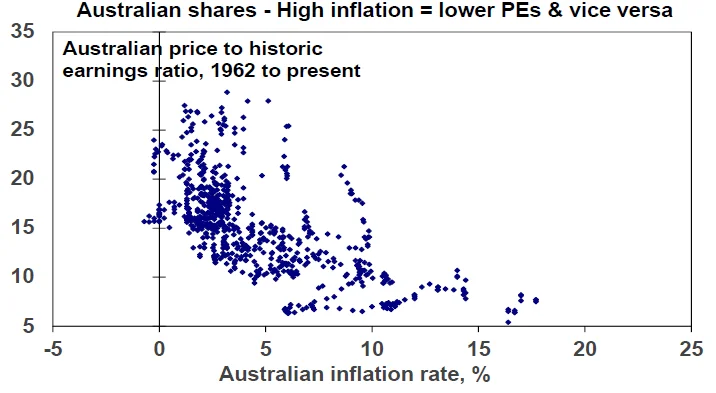

High inflation tends to be bad for investment markets because it means: higher interest rates; higher economic uncertainty; and for shares, a reduced quality of earnings. All of which means that shares tend to trade on lower price to earnings multiples when inflation is high, and growth assets trade on higher income yields. We saw this in 2022 with bond yields surging, share markets falling and other growth assets pressured.

Source: Bloomberg, AMP

So, with inflation falling much of this goes in reverse as we started to see in the last few months. In particular:

- Interest rates will start to come down. We expect the Fed to start cutting in May & the ECB to start cutting around April both with 5 cuts this There is some chance that both could start cutting in March. We expect the RBA to start cutting around June with 3 cuts this year.

- Shares can potentially trade on higher PEs than

- Lower interest rates with a lag are likely to provide some support for real assets like

Of course, the main risk is if economies slide into recession, which will mean another leg down in share markets before they start to benefit from lower interest rates. This is not our base case but it’s a high risk.

Concluding comment

Finally, while inflation is on the mend cyclically, it’s worth remembering that from a longer-term perspective we have likely now entered a more inflation-prone world than the one prior to the pandemic reflecting: bigger government; the reversal of globalisation; increasing defence spending; decarbonisation; less workers and more consumers as populations age. So short of a very deep recession, don’t expect interest rates to go back to anywhere near zero anytime soon.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist, AMP